No products in the cart.

According to the Nigeria Deposit Insurance Corporation (NDIC), only 1.4 million Nigerians had at least ₦500,000 in savings as of 2023. That is less than 1% of the population.

As of July 2022, the Nigerian Bureau of Statistics (NBS) reported that the country’s inflation has hit 19.64%, the highest in nearly 20 years. Millions of Nigerians are living in extreme poverty and Africa’s largest economy with a GDP amounting to $510.58 billion, seems to be on the brink of collapse that even the ‘rich’ are grunting from the steady decline of the country.

While the cost of most basic amenities like foodstuffs, petroleum products, electricity bills, school fees, clothing and so on, keep soaring daily, the middle class’s purchasing power has been on the low due to rising inflation and can no longer comfortably afford basic amenities and are slowly being dragged to join the “lower class.” Similarly, most people in the “upper class” are being unconsciously downgraded to the middle class where they are barely thriving.

Described as the Giant of Africa, Nigeria has not been able to live up to her name as the gap between the rich and the poor continues to widen at an alarming rate. The middle class which ought to be the backbone of the country’s economy and the driving force behind economic growth and development is slowly shrinking.

So, we ask, “Is Nigeria Wiping Out Its Middle Class?”

Contents

Origin of the Middle Class

The concept of the middle class has its roots in the rise of capitalism in Europe and the United States in the 19th century. One of the founding fathers of sociology, Karl Marx, argued that modern society has only two classes of people, the “bourgeoisie” and the “proletariat” determined by economic factors.

While the owners of factories, businesses, and equipment needed to produce wealth belong to the bourgeoisie class, the workers belong to the proletariat class. Later on, in pre-industrial Europe, the bourgeoisie class experienced sharp modifications wherein the least affluent within the class represented by small entrepreneurs, office clerks, artisans and shopkeepers were renamed as “petty bourgeoisie.”

Nearing the end of the 19th century, in their quest to be differentiated from the core bourgeoisie also known as the “haute bourgeoisie”, the petty bourgeoisie class became known as the “middle class.”

About half of the over 200 million Nigerians are poor and as the economy goes through a tough time, middle-class families can no longer afford to buy and pay for goods and services conveniently.

Hence, the term, “middle”, has to do with the position of individuals in the society who were neither capital owners like those in the bourgeoisie class nor were they providers of unskilled labour like those in the proletariat class. Despite the growth and recognition of the middle class as the society’s cornerstone, it was a feature of only developed economies by the mid-20th century.

The middle-class status was seen as a merited or achieved one instead of an inherited one as the members rose in society due to their talent and effort, making them the engine of innovation and change. However, the dynamics of the middle class in Western countries do not necessarily apply to Sub-Saharan African countries because even though they share similarities in terms of pattern of consumption, education, lifestyle, and ethical values, they differ in their functional position in society, relative position in income distribution and size. In developing countries, the middle class stems residually from the vulnerability analysis where households with the probability of falling into poverty are below a certain threshold like 10%.

This invariably defines the middle class as an important “functioning” in terms of economic security, making this concept appealing to developing countries where a large percentage of the population is extremely vulnerable to falling into poverty. The socio-economic conditions of African countries define who belongs to the middle class and not the ideals that the class is known for in Western societies.

Many authors have a general belief that the middle class is the most controversial of all the social classes which produces economic benefits for the society as a whole and fosters economic development. Rising demand for goods and services by the middle class has also helped in the recent growth of some African economies. Being also viewed as a key political actor in Africa, an example being the Arab Spring, the importance of the middle class in any society cannot be overemphasised.

The middle class is actively involved in restoring democracy, reforming the electoral process, and sensitising the civil society about the importance of democracy and voting. This has helped African countries sustain democratic governance.

Nigeria’s Middle Class

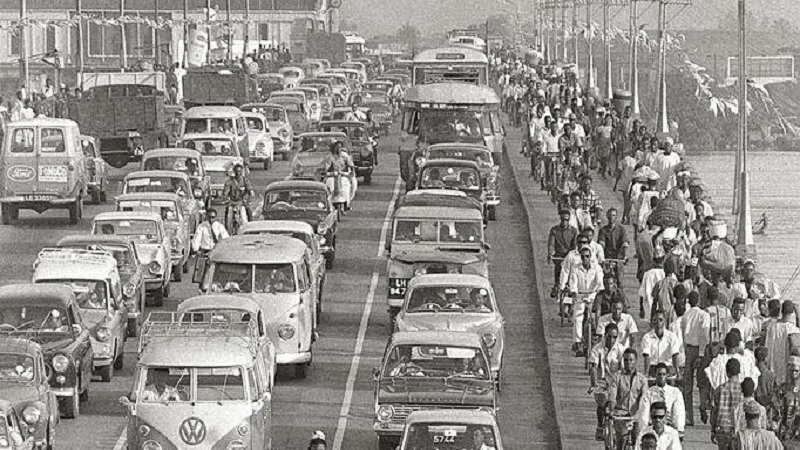

The first comprehensive report on the middle class in Africa was produced by the Africa Development Bank (ADB), defining it in terms of thresholds of consumption per capita income of $2 to $20 per day. Nigeria’s middle class was born in the oil boom of the 1970s with the country experiencing rapid economic growth in the past 10 years which has nurtured a buoyant group of entrepreneurs, professionals and private sector employees often engaged in the thriving financial, information technology and communication sector.

In a recent survey also by the ADB, 23% of Nigeria’s population is made up of the middle class. They are those households having educated professionals who work in industries, factories, and private businesses. They are also government workers. The major spenders in any economy are the middle class and every healthy economy depends on the spending power of the consumers which automatically means that if consumer spending drops, the economy of that country would be stagnated.

Being the largest and most important factor of the economy, it is the pipeline through which every other part of the economy gets its supply as they are the drivers of innovation and entrepreneurship. Most Micro, Small and Medium Enterprises (MSMEs), having entrepreneurship as their foundation, make up about 50% of Nigeria’s Gross Domestic Product (GDP) and 90% of businesses, thereby contributing over 60% of employment opportunities while innovation pushes the economy by introducing new products to the market which the middle class purchase.

The middle class are job creators but when all is not well with the country, workers are laid off and unemployment increases leading to rampant vices like armed robbery, kidnapping, banditry, and the like in the society.

In recent years, about half of the over 200 million Nigerians are poor and as the economy goes through a tough time, middle-class families can no longer afford to buy and pay for goods and services conveniently. From 2004 to 2014, the World Bank carried out research and revealed that Nigeria had a surge in the number of middle-income earners resulting from the rapid economic growth at the time but the tide has turned because, until recently, the country was tagged the world’s poverty capital for three consecutive years.

The country’s current minimum wage of ₦30,000 has been unable to stand firm in the face of the current economic downturn caused by the rising inflation leading the World Bank to reveal that there is a need to urgently introduce a robust economic reform.

Although the government has a case to answer concerning the ever-dwindling economy and the coronavirus pandemic of 2020, the worldwide lockdown worsened the rising inflation in the country and led to recession which harmed businesses and the local economy. Nigeria is yet to recover from her economic woes which looks, more or less, like an endless tunnel.

The once vibrant middle class is gradually fading out as it has been a struggle in futility for the middle class to maintain its stance and not sink to the lower class, and for the lower class to upgrade to the middle class.

Factors that Led to Nigeria’s Dwindling Middle Class

In Nigeria, middle-income households have experienced disappointing income growth which has stunted the development of the economy, and this could be as a result of several factors.

Firstly, the high level of insecurity which has plagued the country has been fingered as one of the causes of the near extinction of Nigeria’s middle class.

Farmers are afraid to go to their farms due to fear of being kidnapped or killed by bandits. Most parts of the country have been left underpopulated due to a rise in rural-urban migration as people are running from villages to cities because of the rampant attack on the citizens while children are no longer safe in their boarding houses.

Insecurity in the country has invariably increased the rate of food inflation as farm produce is now scarce, food prices have increased, and food importation is on a high with the latter putting pressure on the already scarce foreign currencies.

Secondly, the educational sector has been on a dismal course with repetitive strike actions, thereby, prolonging the graduation dates of most youths and reducing their chances of getting a suitable job when they do graduate as their ages may not be what an employer desires. Eventually, most graduates are dependent on their parents for most of their basic needs at an age when they ought to be independent and making an impact in society.

The middle class is supposed to drive education as educated parents usually ensure that their children are educated which leads to the reduction of the income inequality bracket and promote investments in education and public goods. Sadly, a large number of parents who can afford it, prefer to send their children abroad for education to avoid the frequent school strikes and unemployment issues which in turn weakens Nigeria’s consumer demands.

Thirdly, the health sector has taken a hit with the rampant relocation of the country’s skilled medical practitioners to Western countries where they are better paid and also have the opportunity for further studies, leaving the country’s citizens with no other option but to now rely on private hospitals that reel out exorbitant medical bills before they can access quality healthcare.

It should be duly noted that other sectors of the economy have equally witnessed a mass exodus of qualified professionals, thus weakening the once vibrant labour force of the country. So, instead of the middle class, that is the professionals, to remain in Nigeria and work towards strengthening the economy, they prefer to relocate overseas in search of greener pastures.

Fourthly, apart from the high cost of transportation, that is, as a result of the rise in the prices of petrol and diesel, the issue of insecurity on the roads or rail tracks is another cause for concern. Passengers are either kidnapped and their families billed ransoms or they are killed.

Fifthly, Nigeria’s image has been dealt a severe blow as the country is now seen as being full of corrupt and fraudulent individuals. Apart from government officials, many youths now strive to defraud others and make quick money in order to join the upper class. The educational sector is scorned and viewed as a complete waste of time leading to a popular slang, school na scam. Thus, some of the youths who ought to make up a large percentage of professionals, are chasing money, fame and an easy life with no desire for nation-building.

Next is the devaluation of the nation’s currency. The weak naira is both a result of the country’s failure to diversify its economy and instead wholly rely on crude oil. The scarcity of foreign currencies, especially the US dollar, is due to poor remittance of crude oil proceeds and the rampant emigration of young Nigerians to foreign countries, in search of stable education, well-paid jobs, security, quality healthcare and so on.

Another important factor is the numerous economic recessions the country has passed through due to fluctuations in the global prices of crude oil in the international oil market which has left the economy vulnerable. The government increased borrowing to make up for the shortfall in revenue but this has led to the weakening of the naira against the dollar and government revenue took a nosedive. Inflation rates increased, salaries were delayed, and major contracts could not be completed.

Overall, the current exchange rate regime of the Central Bank of Nigeria, petrol subsidy, increased electricity tariffs, high import tariffs, fuel scarcity and the 2019 border closure policy have all in one way or another, fuelled a surge in prices of common commodities in the country and frustrated the purchasing power of the middle class.

The Way Forward

To minimise the unhealthy squeezing of the middle class and prevent its total obliteration, several steps need to be taken.

Economic reforms should be adopted in various sectors like health, education, and housing because this will go a long way in improving the lifestyles of households in the middle class, and economic policies should be enforced to tackle vulnerabilities at the grassroots which would boost and elevate more households from the lower class to the middle class.

A larger percentage of Nigeria’s population needs to be moved up to the middle class by the government by providing access to quality housing, healthcare, education, and employment. MSMEs should be encouraged to thrive in society without rigid policies or exorbitant tax policies that would impede their growth and sustenance.

The insecurity in Nigeria should be nipped in the bud, large-scale farming should be encouraged by granting loans to farmers and providing farm machinery at subsidised rates. Finally, transparency in government activities would help to encourage the citizens to believe in the prosperity, peace, and progress of Nigeria once more.

Conclusion

The World Bank stated that Nigeria’s accelerating inflation pushed seven million citizens into poverty in December 2022.

To avoid slipping further, all hands must be on deck because for any economy to successfully build a cohesive society, a strong, vibrant, and flourishing middle class is a necessity because they are the backbone of the economy.

Additionally, a well-educated middle class can challenge the government of the day to formulate and promote efficient and honest delivery of services through well-thought-out and planned policies that would lead the country to economic freedom, sustain economic growth and boost the confidence of foreign investors in the country.

But to answer the question, “Is Nigeria Wiping Out Its Middle Class?” The sad answer is YES!

Please stay connected with us through our social media handles and make sure you are subscribed to our YouTube Channel. Together, let’s keep the stories of Nigeria’s past alive.

Leave a Reply

View Comments